UBC study finds owners of pricey Vancouver homes pay very little income tax

A new study from UBC’s Sauder School of Business shows that owners of $3.7-million homes in Vancouver pay just $15,800 in income tax.

“They’re sitting on some of the most expensive real estate in North America, but owners of the priciest properties in Vancouver are paying extraordinarily little in income tax,” said UBC Sauder associate professor Thomas Davidoff, who co-authored the study with Dr. Paul Boniface Akaabre from UBC’s School of Community and Regional Planning and Dr. Craig Jones from UBC’s Department of Geography.

The study, recently published in the Canadian Tax Journal, was based on data from the Canadian Housing Statistics Program and the U.S. and Canadian censuses. It looked at how much tax was being paid by non-corporate owners of residential properties in metropolitan areas.

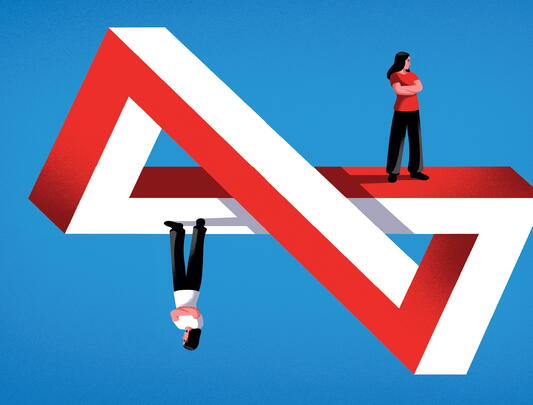

"A total failure of progressivity"

In Greater Vancouver in 2018, the top five per cent of homes had a median value of $3.7 million, but the median income tax paid by owners of those homes was just $15,800 — or 0.42 per cent of their home’s value.

By comparison, owners of Vancouver homes with a median value of $984,000 — less than a quarter of the top tier — paid $12,500 in income tax, or 1.37 per cent of their home’s value.

“At the very top, you see this outrageous pattern. It’s hard to characterize any other way,” Professor Davidoff said. “That people who own $3.7 million-dollar homes pay that little in yearly income tax is a total failure of progressivity.”

The rate was more reasonable in Toronto, where the median value of the top five per cent of homes was $1.8 million, and the median income taxes were $30,700, or 1.69 per cent of the property value, which is more in line with other North American cities.

Vancouver and Toronto typically favour progressive taxation, which is where those who have more pay more through income tax, property tax, and other forms of tax on wealth. However, when people are making millions in the cities’ skyrocketing real estate markets, he says, they’re not paying their share on those earnings.

Leveling the playing field

The study authors suggest implementing a relatively low minimum income tax, which could generate significant revenue for cities. For example, in B.C. the average income tax rate for high earners is 40 per cent — but an average high-end homeowner in Greater Vancouver is paying just 0.42 percent of their home’s value.

Prof. Davidoff says if policymakers imposed a minimum income tax rate of one per cent of that property value, it would bring in an average of $40,000 per year on each property — $25,000 more than what the average top-tier owner is currently paying. If the City of Vancouver brought in $25,000 from 30,000 pricey homes, it would amount to $750 million — and that represents just one half of the top five per cent of properties.

What about low-income people who bought their homes decades ago and can’t afford additional taxes? Prof. Davidoff says there is little evidence that long-time homeowners make up a significant portion of those paying low income tax — but to prevent hurting low-income seniors the tax could be limited to people under 65, or be based on the home’s original purchase price rather than market value.

New taxes can be a hard sell politically, Prof. Davidoff said, but when it comes to housing there’s a widespread perception of unfairness and a desire for change. With a new premier in B.C. and new mayors in Vancouver and other major metropolitan areas, the public may be receptive to a new strategy.