Tariffs threaten Canadian supply chains: Here’s how to prepare and adapt

A UBC expert in geopolitical disruptions and supply chain risk discusses what’s coming and how Canadian consumers and businesses can prepare for the upcoming US tariffs on Canada.

After a chaotic few days of uncertainty, US President Donald Trump announced on Truth Social (on February 27) that sweeping 25-per-cent tariffs on Canada and Mexico would go into effect on March 4. Additional tariffs on steel, aluminum, and auto parts have also previously been announced. We spoke with UBC Sauder School of Business lecturer Samuel Roscoe, an expert in geopolitical disruptions and supply chain risk, to break down what’s coming and how Canadian consumers and businesses can prepare.

As you watch Trump threaten tariffs on Canadian goods, what are your concerns?

The biggest issue for me is the sheer unpredictability: threatening tariffs, introducing them, removing them, then threatening new ones. That creates uncertainty — and businesses hate uncertainty. It becomes very difficult for them to make financial decisions on where to invest and set up production facilities, which suppliers to use and where to source from. When steel and aluminum tariffs were announced last time, businesses had less than a month to react — an impossible task. The uncertainty alone can freeze investment, slow growth, and lead to layoffs.

Which sectors will be hit hardest?

Seventy per cent of Canada’s exports and 50 per cent of our imports are with the US. A 25-per-cent tariff on Canadian goods would actually hit American importing firms the hardest first, as they have to pay the cost of the tariff to the US government. Very quickly, however, American firms will start cancelling contracts with Canadian suppliers, as we no longer have the advantage of the low Canadian dollar, which would be offset by the 25-per-cent tariff.

American companies will look for alternative suppliers outside of Canada, first to American companies and then other countries around the world if there is not enough domestic capacity. While the energy sector is likely to face a lower tariff of around 10 per cent, there will still be a significant impact on Canadian exporters of crude and refined petroleum, particularly in Alberta.

Steel and aluminum will be the next industries to take a financial hit with the ripple effects felt across the supply chain. The issue for Canadian companies is when any retaliatory tariffs come in, they then could be paying tariffs both ways. An example is craft brewing in BC, which employs about 4,000 people across the province. Canada smelts the aluminum, but the US turns it into cans, which are reimported to Canada to be used by the brewing companies. Depending on Canada’s application of reciprocal tariffs, BC’s brewing industry can get hit with tariffs both ways.

Another sector likely to take a two-way hit on tariffs is the automotive sector, which has intertwined supply chains between the US and Canada. Raw material inputs like aluminum and car parts can cross the border seven or eight times before final assembly, so higher costs will quickly pile up. Expect construction, infrastructure, and consumer goods to get more expensive too. For Canadian businesses, it’s a no-win situation. Tariffs will inevitably drive up costs. Companies either have to absorb them — hurting razor-thin profit margins — or pass them on to customers, risking lost sales. Some companies will lose contracts and have to cut production and lay off workers.

What can consumers expect?

It’s a tough situation and consumers are stuck in the middle. We can expect higher prices across the board. For consumers, one of the big ones would be fruits and vegetables, and the prices would immediately go up if retaliatory tariffs were put in place. The same goes for cars, household goods, and anything that relies on US materials.

It’s not just about direct costs — economic uncertainty will slow hiring and wage growth, making it harder for households to keep up.

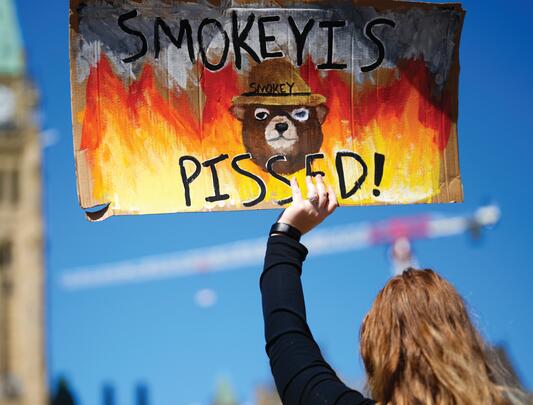

Many Canadians also feel blindsided. This frustration has fuelled a “Buy Canadian” movement. That’s great for small retailers and manufacturers, but Canada’s market is relatively small. Long-term, the solution isn’t isolation — it’s diversification.

Consumers should be aware of what I call the “Canadian supply chain.” If you plan to buy Canadian, it’s important to know that “Assembled in Canada” or “Packaged in Canada” doesn’t necessarily mean the resources used to make the product are from Canada or that the manufacturing actually occurred in Canada. Consumers should look out for labels such as “Made in Canada,” which means the majority of the product and its inputs originated in Canada. What consumers should be asking retailers is: “Does your product have a Canadian supply chain?” and this will mean that the raw materials, manufacturing, packaging, and distribution are happening here in Canada.

What can Canadian businesses do to adapt?

There are five key strategies. The Canadian economy has limited resources and can’t afford protectionist measures so one approach is diversifying both suppliers and customers to reduce reliance on the US, like seeking alternative markets in Europe, South America, and Asia.

Another is coordinated work between policymakers, business leaders, trade associations, and academics on mapping the supply of our critical and strategic industries as well as understanding where all our suppliers are, where we are getting our products from, and who we are selling to. Then you can begin to look at how you diversify your supply chain.

Strategy three is the removal of interprovincial trade barriers. There’s a real push to get rid of these barriers at the moment, especially around things like trucking, limits on alcohol, and allowing qualified individuals such as doctors move between provinces more easily.

Strategy four is moving up the value chain. Rather than exporting raw materials, Canadian industries should focus on producing finished goods for global markets like Europe, China, and India because the transportation costs are lower, and they can be absorbed within the profit margins of the higher value goods. We have to realize this is the state of things: the US is becoming very protectionist, and Canadian businesses have to move up the value chain to become more competitive globally.

Strategy five is establishing regionalized supply chains — by setting up production facilities in multiple regions, businesses can minimize the risks associated with border tariffs and supply disruptions. Companies are also looking at vertical integration — so owning more stages of the supply chain rather than outsourcing everything to third-party companies in India and China, as a way of increasing supply chain visibility and reducing risk.

To read an extended version of this Q&A, visit the UBC Sauder School of Business website.