Canada could lead the world in biofuels: report

Biofuels have long been touted as an alternative to fossil fuels, but the first generation came with a host of problems. Now a new wave of biofuels is hitting the market, and according to a report by the C.D. Howe Institute, it could help drive Canada’s fast-growing green economy.

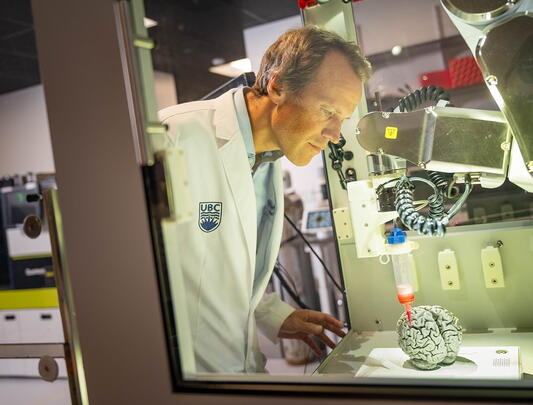

In the report, titled Scaling Up: The Promise and Perils of Canada’s Biofuels Strategy, UBC Sauder School of Business Associate Professor Dr. Werner Antweiler argues that Canada is poised to become a leader in the global biofuels sector, both because of the country’s large agricultural industry and its existing fuel infrastructure.

But it isn’t a done deal: Dr. Antweiler argues the industry will only scale if corporate and government leaders effectively navigate the roadblocks.

Canadians already use biofuels every day. They are in most gasoline blends in the form of ethanol — made from plants, such as corn and wheat, that are fermented to create ethanol from sugars. Similarly, biodiesel is blended with conventional diesel.

Now a new generation of biofuels — which includes renewable diesel, sustainable aviation fuel, and renewable natural gas — is emerging and entering commercialization.

Unlike their predecessors, the latest biofuels can be made from non-food crops, such as perennial grasses and fast-growing trees, as well as agricultural and forestry waste. And while renewable diesel may sound like biodiesel, they are distinctly different, especially since biodiesel is a “drop-in fuel” — that is, it can be used wherever traditional diesel is found without any blending or engine conversion.

“It's exactly the same as conventional diesel — it just comes from a different feedstock. Conventional diesel comes from oil and renewable diesel comes from crops,” Dr. Antweiler says. “So that is a new revolution that's taking place.”

The seismic shift is the result of feedstocks that are rich in oils as well as different production methods — in particular a process known as HEFA (Hydrotreated Esters and Fatty Acids) — that can employ the same cracking units that are also used for conventional fuels. Feedstocks can be co-processed in existing or they can be processed in dedicated new facilities.

“You basically deliver the feedstock from the crops and turn that into the precursor. Then it goes into the standard refining chain and it comes out as an ordinary refined product without any physical difference,” Dr. Antweiler says. “So that's where we see the innovation.”

The Canadian biofuel industry has been stagnant in recent years, he adds, but now it’s rapidly gathering steam, with next-generation plants opening in locales from Come By Chance, Newfoundland, to Edmonton, Alberta, to Prince George, BC.

That’s driven in part by government policies such as BC’s Low Carbon Fuel Standard and the federal Clean Fuel Standard, which require producers to go through strict life cycle assessments to ensure carbon reductions across the entire process, from farming to shipping.

“There is now a guaranteed market for growing biofuels, and incentives that are aligned with the reductions in carbon intensities from different fuels,” Dr. Antweiler says. “So the baseline carbon intensity isn't just from burning the fuel in the car: it's also the emission intensity that is associated with the production.”

That doesn’t mean the next generation of biofuels are going to have an easy ride, Dr. Antweiler warns. Sustainable aviation fuel, renewable diesel, and renewable natural gas all have unique challenges, among them production costs, which today remain significantly higher than for conventional fuels.

It will also be difficult to scale to the point where the biofuel industry can meet current fuel demands given the limited supply of feedstock, Dr. Antweiler adds. What’s more, the production of feedstock can come with its own negative spillover effects — land use change, deforestation, and water scarcity to name a few.

Canada is especially suited to biofuel production because it’s a large country with vast swaths of land that aren’t suitable for food growing, but could be used to raise plants for fuel; it also has infrastructure where biofuels could be produced. Already, large companies like Imperial Oil are investing heavily.

Dr. Antweiler hopes political parties of all stripes will come to see the environmental and economic potential of biofuels, that jurisdictions across North America adopt the same lifecycle assessment system, and that Canadian producers will be allowed access to the US market.

“I can clearly see the pathways that will make it attractive to develop the biofuel industry — and that will lead to more innovation, which lowers the cost,” says Dr. Antweiler, who adds the technologies are developing quickly. “I'm very hopeful that Canada could lead the energy transition for motor fuels.”