When CEOs admit failures, stock analysts value their companies more highly

In business, leaders rarely want to take accountability for unfavourable company performance — but a new study from the UBC Sauder School of Business shows that when they do, they might actually boost the value of their companies.

In the study titled “The role of CEO accounts and perceived integrity in analysts’ forecasts,” researchers electronically combed through more than 35,000 CEO conference calls to investors that spanned 12 years (2002 to 2013), and looked at whether the companies performed favourably or unfavourably.

They examined how CEOs explained their companies’ performance on quarterly earnings calls, and whether leaders attributed it to internal causes like strong leadership and effective decision-making or external forces like supply issues, geopolitical conflicts or economic shifts.

When a company performed unfavourably and the CEO held themselves accountable, analysts’ forecasts were significantly higher than when the CEO blamed outside forces.

Not surprisingly, the researchers found that when a company’s performance was favourable, financial analysts’ forecasts were higher — and the way CEOs explained their success didn’t have a significant impact.

In a follow-up experiment, researchers gave fictional earnings call scripts to 300 real-world financial analysts. In some, the CEO blamed external forces for lower-than-expected quarterly results; in others, they took responsibility. The researchers then asked the analysts to share their perceptions of the leader and provide a forecast.

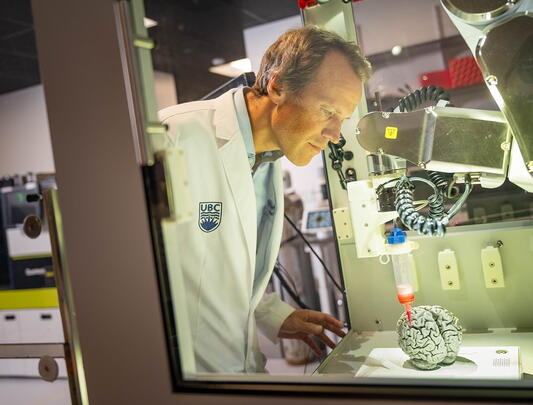

“Again we found that CEO accounts didn’t matter a whole lot when the company performed favourably,” explains UBC Sauder professor Dr. Daniel Skarlicki, who co-authored the study with UBC Sauder associate professor Dr. Kin Lo, Dr. Rafael Rogo from the University of Cambridge, and Dr. Bruce Avolio and CodieAnn DeHaas from the University of Washington.

“But when the performance was unfavourable and CEOs pointed to internal factors — things they were responsible for, they scored higher in integrity — and that higher integrity in turn yielded higher financial forecasts.”

Why would analysts value a company whose top leader takes the blame for bad news? Dr. Skarlicki points to a psychological phenomenon called the actor-observer bias: When a business does well, the CEO tends to credit internal forces, but outside observers are more likely to attribute the success to external factors. Similarly, when things go wrong, the CEO often points to outside forces, while outsiders scrutinize the CEO. When a CEO admits their mistakes, it can make them seem more trustworthy which can benefit the company.

In 2014, in an effort to compete with Apple and Google, Microsoft acquired Nokia’s mobile phone division for over $7 billion. The decision proved to be a failure. Rather than deflecting blame, Microsoft CEO Satya Nadella took immediate responsibility and initiated a massive restructuring with a focus on cloud computing and productivity software. Their stock price ultimately soared, Dr. Skarlicki explains.

These findings could be instructive in other corners of society. The way coaches in college or professional sports, who regularly provide accounts for wins and losses to fans and media, can have significant consequences on how they are judged.

“When a hockey team does well, they say it was good coaching, good practices, good strategy,” Dr. Skarlicki explains. “But when that hockey team does badly, they say it was things like their travel itinerary.” When coaches take accountability, perceptions of their integrity are enhanced, and that has implications on how they are viewed, compensated, and retained by their teams/institutions.

Political leaders would also be wise to be contrite when they make mistakes, to improve perceptions of their integrity among voters, donors, and volunteers.

“Leaders avoid being accountable for failures because they feel like it’s a risk or a potential danger. But observers actually view leaders who are truthful, accountable, and transparent more favourably,” Dr. Skarlicki said. “We were also excited that we could actually quantify the financial payoff of integrity, and the bottom line is that accountability matters. Deflecting responsibility can be a bad strategy.”